Security Financial Private Investment Counsel

Advisor Partnerships

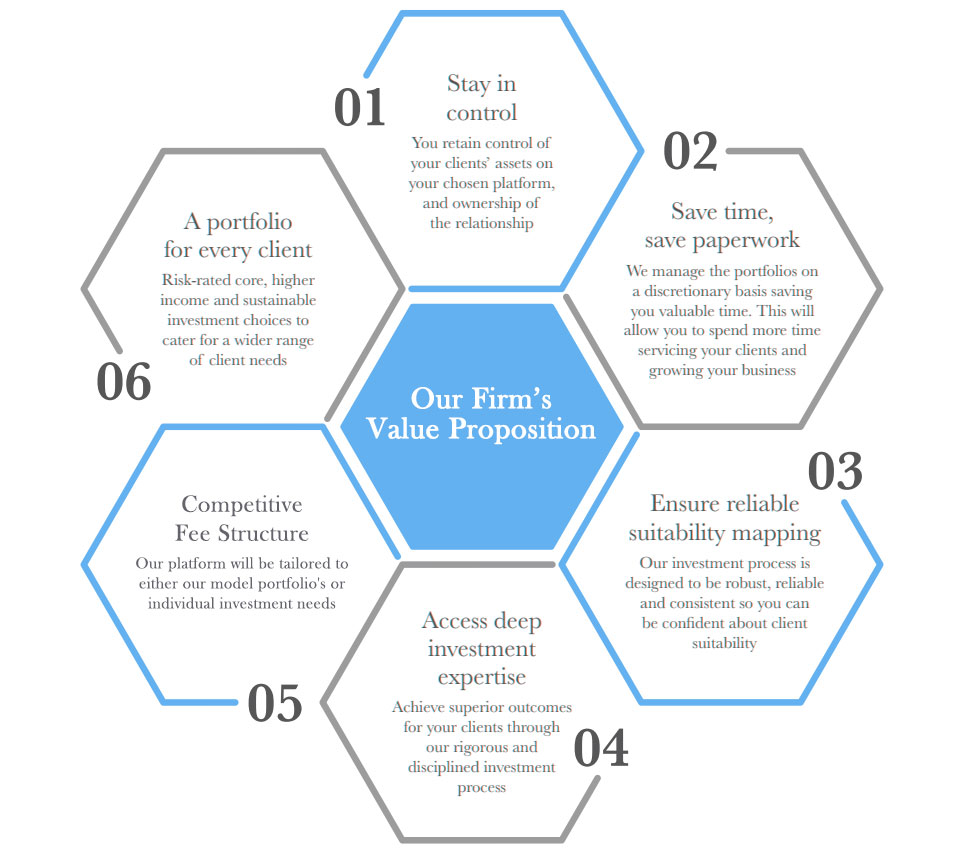

Security Financial Private Investment Counsel strives to provide our advisor and portfolio manager partners a state-of-the-art platform for their respective practice and clients.

Based on the Investment Policy Statement, the portfolio manager will closely monitor all your client portfolios to ensure they are suitably invested at all times. Depending on your clients’ attitudes to risk, requirements for income, tax situations and particular preferences, the portfolio manager will build and actively manage portfolios to match their individual needs, and incorporate existing investments wherever appropriate.

As a discretionary portfolio manager, we manage the portfolios on a day-to-day basis, make any changes we feel are necessary, and promptly communicate those changes to you. At least once a year, a review meeting will take place to ensure all portfolios are reflecting your clients’ needs. Outside of that review, you will always have access to the portfolio manager if you have any questions about your clients’ portfolios. Our team is on hand to answer any day-to-day queries that arise! Furthermore, Security Financial Private Investment Counsel will provide quarterly statements, which includes performance reporting and fee disclosures.

Investments are custody held with Raymond James Correspondent Service which also manage the collecting and distributing of dividends and other income payments, corporate actions and executing all trades promptly.

Our firm offers a complete outsourced investment solution which grant clients access to world class sub-advisors at management fees lower than conventional mutual funds.

Our Model Portfolio Service is part of our suite of outsourcing solutions offered to Financial Advisors and is specifically designed to meet client’s Investment Policy Statement goals. Model Portfolios are a cost-effective way of accessing a diversified and actively managed portfolio of investments. They are designed to make it easier for you to help your clients achieve their investment objectives, taking into consideration their risk profile.

We can also offer a range of tools and services to help you to deliver the best possible service and outcomes for your clients:

- Virtual meetings

- Market commentaries

- Joint client seminars

- Client-facing brochures

Mutual Fund Representatives

Over the last decade, regulatory burden in the mutual fund dealer community has grown exponentially. Now, MFDA Dealers will soon be forced to join a hybrid Self Regulatory Organization along with IIROC Dealers, further adding to regulatory and business uncertainty.

Many of your fellow industry participants are looking for a solution that will, reduce their business risk, give them operational freedom, protect their book of business and protect their investors.

If you are a mutual fund representative or small Mutual Fund Dealer, Security Financial Investment Counsel Inc. may be the next and most important step in the advancement of your career or the development of your firm.

Security Financial has a strong and deep connection to the Mutual Fund Dealer Community. With over 20 years experience running his own MFDA Dealership, Leo Belmonte is well aware of the challenges and needs of independent mutual fund dealers and representatives.

If you would like to have a private conversation on whether your business may be ready to operate under a discretionary business model, please send us a confidential message here.

Portfolio Manager Partnerships

Over the last decade, regulatory burden in the mutual fund dealer community has grown exponentially. Now, MFDA Dealers will soon be forced to join a hybrid Self Regulatory Organization along with IIROC Dealers, further adding to regulatory and business uncertainty.

Security Financial Private Investment Counsel provides a turn-key platform for other Portfolio Managers whether with IIROC or unwilling to establish their own firm.

IIROC Representatives

Shrinking commission grids and higher minimum book sizes has created a lot of unnecessary stress for investment professional that currently operate under an IIROC registration.

If you are looking for a safer, more lucrative and less burdensome solution, let’s have a conversation on whether the Security Financial Private Investment Counsel platform may be a good fit.